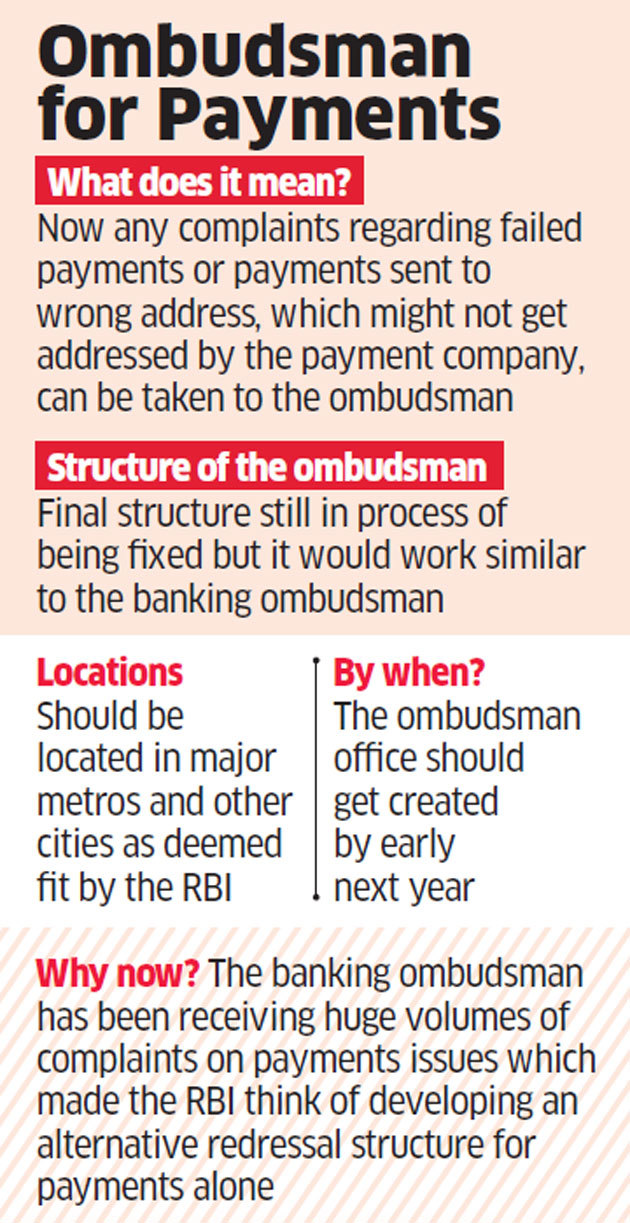

The Reserve Bank of India is planning to set up a payments ombudsman to tackle the growing number of consumer complaints arising from digital transactions.

This information was revealed by the ET.

Most of the customer complaints relate to digital transactions with PayTM, Amazon, Flipkart, Snapdeal, Zomato, Tata Sky, Gozefo, swiggy etc.

Increase in consumer complaints of digital payments

The RBI has noted that the increasing volume of complaints involving digital payments being received by the offices of the banking ombudsman and the large number of prepaid payment instruments issued by banks and non-bank issuers have necessitated establishment of a separate ombudsman for digital transactions.

The RBI is presently in the process of creating a scheme for establishing offices across the country for the digital payments ombudsman.

This will take the load off the increasing number of complaints currently being handled by the banking ombudsman.

The move is timely because of the rapid adoption of digital payments across the country.

In fact, the RBI in its Annual Report for 2017-18 had said it was considering a plan to establish a separate ombudsman to handle consumer complaints related to digital transactions.

A senior official of the RBI stated that the ombudsman’s office could be set up by early 2019.

The scheme will be similar to the working of the banking ombudsman.

Under the RBI’s banking ombudsman scheme 2006, there are various criteria on the basis of which consumers can make complaints to the ombudsman.

An RBI official in the rank of chief general manager or general manager is the ombudsman.

failed transactions, money sent to the wrong account

Many consumer complaints that arise from digital transactions relate to failed transactions or funds sent to the wrong address.

Such complaints will be handled efficiently through the ombudsman mechanism.

The RBI will also collect information on the various types of frauds that are being reported in the overall payments space.

The RBI’s overall aim is to reduce instances of fraud and ensure that confidence in the payment systems goes up.

customer grievance redressal framework

In 2017, the RBI issued instructions to mobile wallet issuers and non-banking payments entities to establish a publicly disclosed customer grievance redressal framework.

The master circular issued in October 2017 stated that the publicly disclosed customer grievance redressal framework should designate a nodal officer to handle customer complaints, the escalation matrix and turnaround time for complaint resolution.

The complaint facility has to be made available on website/mobile and be clearly and easily accessible.