This is a complete guide which explains the procedure to avail of MSME Loan in 59 Minutes. The entire procedure is explained with pictures and there is also a complete FAQ which answers all frequently asked questions.

At the end of the Guide, you will know how to avail of the MSME loan from PSB and receive Rs. 1 crore at low interest rate.

Table of Contents

(1) What is https://www.psbloansin59minutes.com?

(2) Salient features of PSB loans in 59 minutes scheme

(3) Documents required to avail of the 59 minute loan

(4) 10 easy steps for MSMEs to avail of Rs 1 crore loan in 59 minutes

(5) Frequently Asked Question (FAQ)

If you have any questions, use the comment box to ask us

https://www.psbloansin59minutes.com

Prime Minister Narendra Modi stated that getting access to credit is a major challenge for the MSME sector.

In order to mitigate this challenge, he announced that through a portal, a loan upto Rs. 1 crore would be available in just 59 minutes.

To implement the decision of the Prime Minister, a portal named ‘https://www.psbloansin59minutes.com’ has been set up by the Government.

The portal will issue loan approvals for up to 1 crore for the MSME sector.

In fact, already more than 72,000 MSMEs loan requests have been approved.

The Chief Minister of Gujarat, Shri Vijay Rupani distributed loan sanction letters to as many as 25 MSME applicants.

In total, 10,000-odd applications of the MSME applicants have been sanctioned in Gujarat.

Devendra Fadnavis, the Chief Minister of Maharashtra, stated that these reforms will help a lot to MSMEs, as they are the largest employment generators.

This will also help entire revival of MSME sector.

Maharashtra has granted around Rs 60,000 crore loans under the Mudra Yojana.

In effect, PSB Loans in 59 minutes is an online marketplace, which will enable In-Principle approval for MSME loans up to INR 1 Crore in 59 minutes from Public Sector Banks.

This Platform has reduced the loan processing turnaround time from 20-25 days to 59 minutes. Post receiving of In-Principle approval letter, the loan is expected to be disbursed in 7-8 working days.

The loans are processed without human intervention till sanction and/or disbursement stage. On this platform, MSME borrower is not required to submit any physical document for In-Principle approval. The solution uses advanced algorithms to analyze data points from various sources such as IT returns, GST data, Bank Statements etc.

Salient features of PSB loans in 59 minutes scheme

MSME borrowers can avail of automated processing of loan with an in-principal approval in just 59 minutes.

The automated, contact-less business loan approvals are currently provided for loans worth Rs 10 lakh to Rs 1 crore.

The rate of interest starts from 8%.

Collateral coverage is not mandatory because these loans are connected to the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) scheme.

The turnaround time is reduced from 20-25 days to 59 minutes.

After approval, the loan will be disbursed in about a week.

https://www.psbloansin59minutes.com

The salient terms are as follows:

|

Loan sanctioning platform |

PSB Loans in 59 Minutes |

|

Banks disbursing loans |

(i) SIDBI |

|

Amount of loan |

From Rs 10 lakh to Rs 1 crore |

|

Interest rate |

8% |

|

Collateral |

Not required |

|

Time for sanction of loan |

59 Minutes |

|

Time for disbursal of loan |

1 week |

|

Toll Free Number |

1800 103 7491 |

|

Helpline Number |

+91 95120-15768 |

|

Email Id |

|

|

|

|

Documents required to avail of the 59 minute loan

While accessing the Government portal to avail of the loan, all applicants should have the following details and soft copies of documents:

1) GST Identification Number,

2) Income tax returns in XML format or your PAN and date of incorporation,

3) Bank statement for last six months in PDF format or your netbanking credentials,

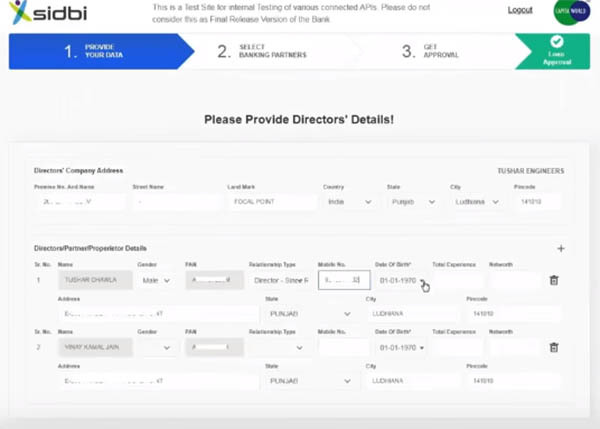

4) Details of director and owners and other basic ownership details.

These documents are required at the stage of sanctioning of the loan. Further documents mat be called for by the Bank at the stage of disbursal of the loan.

10 easy steps for MSMEs to avail of Rs 1 crore loan in 59 minutes

All MSMEs desiring to avail of the loan are required to follow the following ten steps.

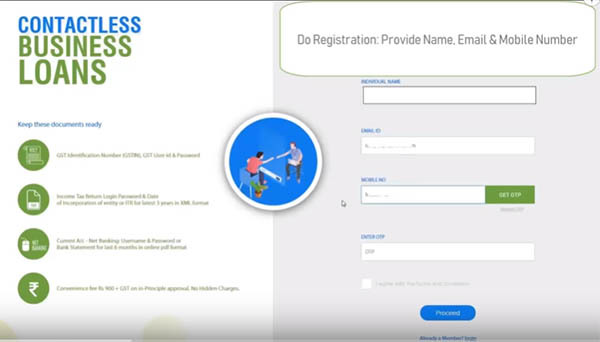

1. Register

Provide your name, email address and a mobile number on which you will receive and OTP.

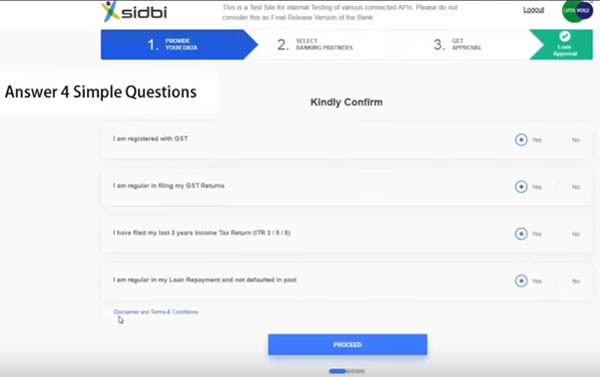

2. Answer 4 questions

You need to answer four simple questions such as whether you are registered with GST and have been filing your GST returns regularly and have never defaulted on a loan.

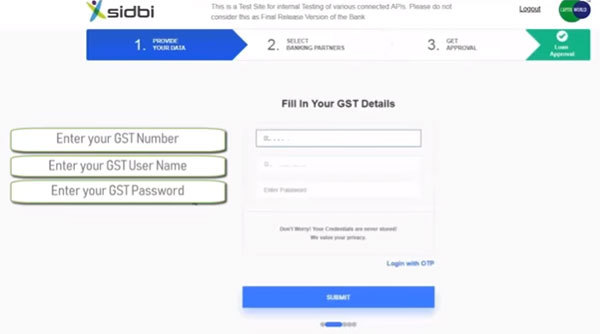

3. Provide GST details

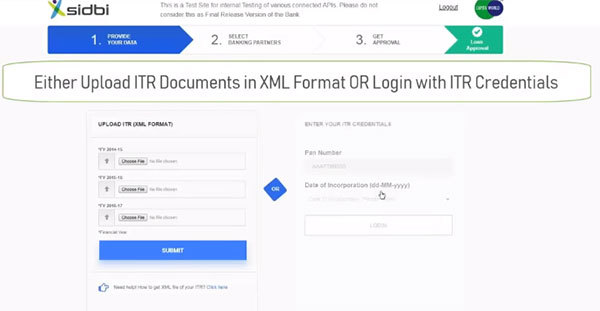

4. Provide tax info

You can either upload your tax returns in XML format or login with your tax credentials — your PAN and date of incorporation.

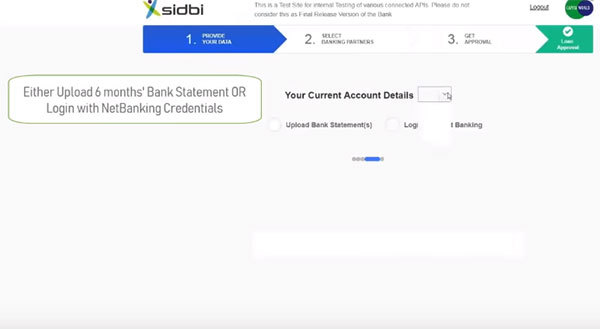

5.Provide bank account info

You can either upload your bank statements or log in with your netbanking credentials.

6. Provide details of company directors

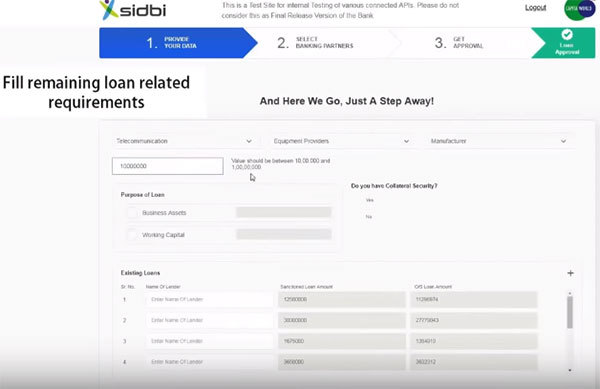

7. Provide loan info

Now you have to provide details of your business, the purpose of loan, any collateral security and any previous loans.

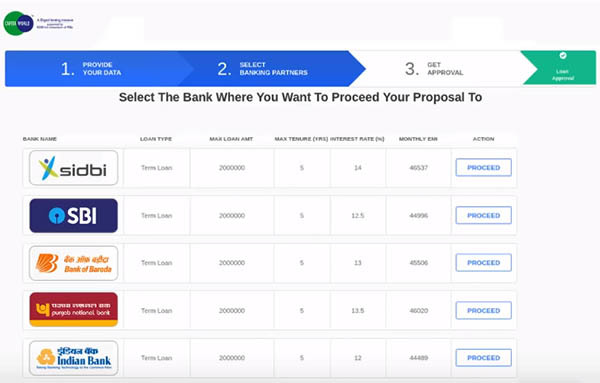

8. Select the bank

Select the bank from where you want a loan. Currently, about a dozen banks are linked with this website.

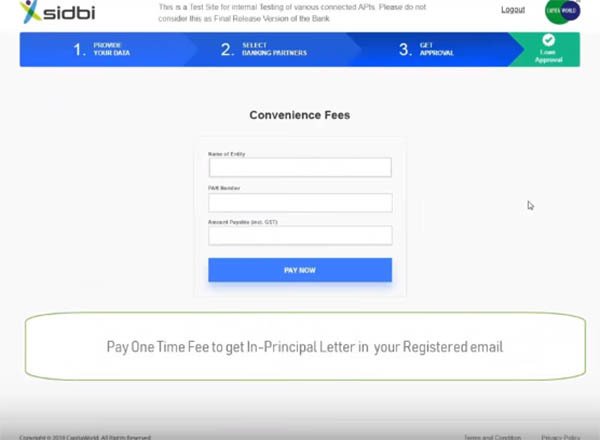

9. Pay fee

You will have to pay a convenience fee of Rs 1,000 + GST.

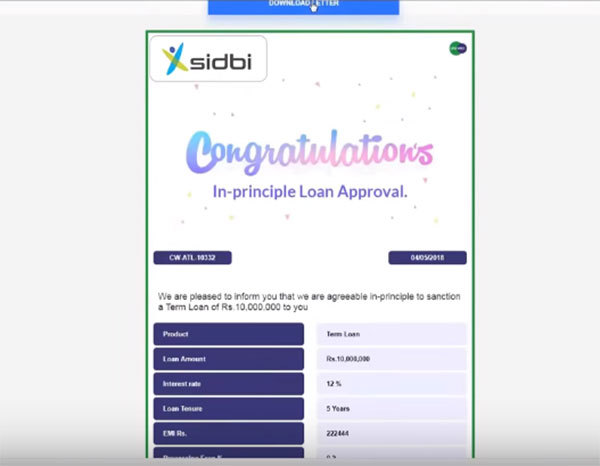

10. Download approval letter

This is the last step. Your approval letter is ready to be downloaded.

Frequently Asked Question (FAQ)

MSME Loan

Sign Up, Password Creation & Login

General

Q1 What is the minimum and maximum loan amount one can borrow through the portal?

An MSME can avail business loan from Rs 1 Lakh to Rs 1 Crore through www.psbloansin59minutes.com.

Q2 How do I make a loan application/ submit Proposal?

Applying for a loan at www.psbloansin59minutes.com.is a simple process:

− Click on above mentioned URL.

− Register using Name, Mobile Number and Email Id

− Post Registration, provide required details to avail business loan approval within 59 minutes.

Q3 Do I need to provide fees for registration

No, you don’t need to pay the registration fee.

Q4 Are there any eligibility criteria for the borrowers?

For Existing Businesses: Borrower should be GST, IT compliant and must have Net Banking Facility.

Q5 What data/ documents will I need to submit if I want to make an application on www.psbloansin59minutes.com?

An Existing business wishing to make an application on the www.psbloansin59minutes.com, requires the following:

a. GST Details: GST Identification Number (GSTIN), GST User Name and GST Password

b. Income Tax Details: Either Upload latest 3 years ITR in XML format

or

Provide PAN, Date of Birth/ Incorporation, Password of Income Tax Account on www.incometaxindiaefiling.gov.in

c. Net Banking Details: Either upload Bank Statements for last 6 months in PDF format

or

Provide Login ID and Password

(Borrower can upload Bank Statements for Maximum 3 Bank Accounts on the Portal. Please upload bank statements having Major Business Activities)

d. Details of Directors/Partners/Proprietor

e. Details related to Loan Required

Q6 Why details related to my Bank Statements/ GST/ ITR are required to be uploaded on www.psbloansin59minutes.com?

To ensure fast, easy and hassle-free loan evaluation process, we need certain details related to your personal and business to ensure authenticity and check eligibility for credit. The Bank Statements/ GST/ ITR details uploaded by the borrower are analyzed in real time to provide required data to lenders, based on which the banker will take a decision on Sanctioning/Disbursing the proposal. Please be ensured, your all personal and business specific data is secure with us. We assure that "your credentials are never stored".

Q7 Is www.psbloansin59minutes.com a secure Platform? Is my data secure with the portal?

Your data is our utmost priority. The portal collects sensitive data for real time loan evaluation process. Your data is safe with our cloud servers.

Q8 What assurance do I have that my data will not be mis-utilized?

At www.psbloansin59minutes.com, we venture to provide a safe and secure environment for the borrowers to complete their journey. The Login Credentials for GST, Income Tax and Net Banking are never stored and are only utilized to get the required data for analysis.

Q9 What if I do not file/have GST Return/Income Tax Return/Banking Details?

We are sorry, you will not be able to complete the borrower journey on www.psbloansin59minutes.com

Q 10 I am GST/ ITR and Net Banking Compliant. Though, I currently don’t have all the details required for the application process. What should I do?

Kindly ensure you got all the documents required in digital format for the application process. In case you don’t have some documents, kindly log out from the platform. Collect all the required documents and again login using your registration credentials. You don’t need to start again from the beginning. You will be directed to the page where you pressed log out. Enter your details and proceed further. In case of any further assistance, feel free to call us on our toll-free number 1800 103 7491.

Q 11 Do I have to make any payment for receiving the In-Principle approval?

For registration purpose, the borrower doesn’t need to make any payment. Any borrower whose proposal matches with the products of lenders and wants to receive an In-Principle approval will be required to make a nominal payment of Rs. 1,000 + Applicable Taxes.

Do I need to pay any charges towards availing a Loan through www.psbloansin59minutes.com?

For registration purpose, the borrower doesn’t need to make any payment. Any borrower whose proposal matches with the products of lenders and wants to receive an In-Principle approval will be required to make a nominal payment of Rs. 1,000 + Applicable Taxes.

Q. 12 Will I receive a loan if I pay the amount required and receive an In-Principle approval?

The In-Principle approval is given based on the data provided by the borrower. After offering In-Principle Approval, the preferred lender (as selected by borrower) will conduct a thorough due diligence and decide on whether to Sanction/Disburse the Proposal. The final decision will be at the lender’s discretion.

Q. 13

Is the In-Principle Approval a surety of Loan Sanction?

The In-Principle approval is given based on the data provided by the borrower. After offering In-Principle Approval, the preferred lender (as selected by borrower) will conduct a thorough due diligence and decide on whether to Sanction/Disburse the Proposal. The final decision will be at the lender’s discretion.

Q. 14 How do I check the status of my application?

Post receiving In-Principle Approval, you can check the status of your application on the web portal by signing in with your registration details.

Q. 15 In how much time I will get final decision and receive funds?

Through the web portal , a borrower can get in-principle approval in just 59 minutes from anywhere at any time. Post in-principle approval, the time taken for loan disbursement depends on the information and documentation provided by you on the portal and banks. The more accurate the data, the sooner you will get disbursal. Generally, post in-principle approval, the loan is expected to be disbursed in 7-8 working days.

Q. 16 I accidentally pressed log out while in middle of the application process? What should I do?

Don’t worry. Login again on web portal with your registration credentials. You don’t need to start again from the beginning. You will be directed to the page where you pressed log out or got disconnected.

Q. 17 I accidentally got disconnected while in the middle of the application process? What should I do?

Don’t worry. Login again on web portal with your registration credentials. You don’t need to start again from the beginning. You will be directed to the page where you pressed log out or got disconnected.

Q. 18 Why my application is not eligible for In-principle Approval?

Your application might get rejected due to one or more of below mentioned reasons:

a. You answered Negative in at least in one of the primary questions

b. Your credentials do not match across documents provided by you

c.Your business does not clear various parameters set by banking partners

I did not receive OTP. What should I do?

We send OTP to registered mobile as well as to Email Id. Kindly check if you have received or not in both or either of them. In case not received, contact us on our toll-free number 1800 103 7491.

Q. 19

What is Collateral?

A security in form of asset offered by the borrower to a lender for securing a loan. In case of default from the borrower in repayment of the loan, the collateral can be used to recover losses.

Q. 20 Do I need to provide Collateral to avail loan through the portal?

Even if the borrower does not have collateral security, he/she can avail business loan through https://www.psbloansin59minutes.com under CGTMSE scheme.

Q. 21 What is Turnaround Time?

Turnaround Time (TAT) is the time taken by a lender in processing a loan application, from submission of proposal to sanction and disbursement.

Q. 22 How does https://www.psbloansin59minutes.com reduces the Turnaround Time?

The platform requires submission of borrower’s data and runs analysis on the same in real time basis. The details are matched with Various Criteria set by all Lending Banks on the Platform. Borrower will be shown a List of Banks with whom the Application got matched with and from those Banks the Borrower can select his/ her preferred lender.

Sign Up, Password Creation & Login

Q. 23 What are the details that I require for registration (sign-up) on https://www.psbloansin59minutes.com?

Any person interested to register (sign-up) on https://www.psblaonsin59minutes.com and receive an in-principle approval, only needs a valid E-Mail Address and a Mobile Number.

Q. 24 What is the process to sign-up?

a. Fill in the Name, E-Mail Address and Mobile Number, and click on "Get OTP"

b. Enter the OTP received on the Mobile Number provided

c. Tick on the "I agree to Terms and Conditions" check box

d. Click "Proceed"

e. Create a Password and confirm the same

Q. 25 How should I Login into my account?

a. On the Sign-Up Page, click on "Login" provided next to "Already a Member?"

b. Login through Your Registration Credentials:

Through Registered E-Mail ID and Password

Or

Through Registered Mobile Number and OTP

Q. 26 I forgot my password. What should I do?

a. Login using the OTP by entering the Mobile Number.

Or

b. Enter the registered E-Mail Address and click on the "Forgot Password?".

You will receive a mail to reset your password on the E-Mail Address Provided.

MCQ

Q. 27 What if the answer to any of the question is in negative? Will I be able to proceed with my application?

We are sorry, you will not be able to proceed if answer to any of the question is "NO".

GST

Q. 28 I do not have the password for GST login, is there any alternative?

If you do not have GST Login password, click on "Login with OTP", provide the required details and you will receive an OTP on the Mobile Number registered on GST Portal.

Q. 29 While trying to receive OTP, an error message was displayed stating "API Access Denied".

The error occurs when the API access is not allowed on the GST Portal. Click on the video link provided to view a tutorial on how to turn on the API Access on the GST Portal. Turn on the API Access on the GST Portal and then try again.

Income Tax Returns

Q. 30 Do I have to mandatorily upload Income Tax Returns for past 3 years?

The borrower can proceed by uploading even a single year’s Income Tax Return, however it will be beneficial if Income Tax Returns for all the years are provided.

Q. 31 I have not yet filed the return for the latest financial year? Will the Income Tax Return for past financial year be accepted?

If a borrower has not yet filed the Income Tax return for latest financial year, he/she can upload the Income tax Return of past financial year(s).

Q. 32 I used to file Salary Return in past financial years and have only one year of Business Income Return. Can I proceed with my application?

Yes, the borrower can proceed with uploading Income Tax Return if the return in latest financial year is a Business Income Return, irrespective of the returns filed in the past previous years.

Q. 33 I am not in possession of the XML files of the Returns filed. Is there any alternative?

The borrower can opt to provide Login Credentials of https://www.incometaxindiaefiling.gov.in

Follow below mentioned steps:

a. Provide ‘Date of Incorporation’ below the ‘PAN’

b. Click on "Login" and you will be redirected to another Page

c. On the redirected page, provide the ‘e-filling password’ and click on "Next"

d. Enter the CAPTCHA displayed on the screen and click on "Submit"

e. Borrower will be redirected to Bank Statements Page

Q. 34 How to download XML files of Income Tax Return filed (if I do not want to provide the Login Credentials)?

Click on the Link: "How to get XML file of your ITR?" And follow the instructions provided to download the XML files from the https://www.incometaxindiaefiling.gov.in and upload the same on the platform.

Q. 35 I am filing my Income Tax Returns under Presumptive Taxation or I file ITR form 4/4S. Can I proceed with my application?

Yes. There are products created by lenders for borrowers who file their Income Tax Returns under Presumptive Taxation or file ITR form 4/4S.

Bank Statement

Q. 36 Do I need to upload bank statements of entire year?

No. The borrower needs to upload Bank Statements of the last 6 months only.

Q. 37 I have Bank Statements in Physical Form. Can I upload after scanning them? (MSME)I have Bank Statements in Excel. Can I upload them directly or by converting them into PDF files?

The Bank Statements that the borrower needs to upload should compulsorily be in the PDF format and should be downloaded from Net Banking Facility or received from the Bank every month. Any other format converted to PDF format will not be accepted.

Q. 38 I do not have my Bank Statements in the PDF format. Is there any alternative?

The borrower has an option to provide the Credentials for Net Banking i.e. the Login ID and Password. The platform will automatically fetch the required data. Follow below mentioned steps to upload Bank Statement using Net Banking Credentials:

a. Select the number of accounts you want to upload.

b. Tick "Login with Net Banking" and Click on "Net Banking" Button.

c. Borrower will be redirected to Net Banking Page

d. On the Net Banking page, select your bank from dropdown list, provide your Login ID, Password and Confirm Password

e. Click on "Next"

f. If prompted, provide OTP or Access Code and Click on "Submit"

g. The borrower will be redirected to Bank Statement Upload Page, where he can proceed to upload another statement or can move ahead by Clicking "Proceed"

Please note, Your Login Credentials are never stored

Q. 39 Will my credentials be stored/saved? What assurance do I have that my credentials will not be mis utilized?

At ww.psbloansin59minutes.com we venture to provide a safe and secure environment for the borrower(s) to complete their journey.

The Login Credentials for GST, Income Tax and Net Banking are never stored and are only utilized to get the required data for analysis.

Q. 40 I have Net Banking, but my bank is not displayed in your list. What can I do?

It seems that your Bank is not currently supported by the platform, kindly upload the Bank Statement of another bank.

Director’s Details

Q. 41 Why do I need to provide all these details?

The details of the Directors/Partners/Proprietors are required for assessment of borrower’s proposal against the parameters of lenders.

These details will help us better match you with a suitable lender. Furthermore, the details are required to check the Bureau Score of all the Directors/Partners/Proprietor, to check for credit history of the organization as well as its managers.

Q. 42 I have filled all the details required, however there are no values to select from in Village/District/Sub-District tabs?

It seems that your Pin Code is not listed in the system, kindly provide a Pin Code of the nearest area and select the Village/District/Sub-District from the drop downs.

Q. 43 I do not have the exact figure of my Net-worth, will an estimate be acceptable?

Yes. Borrower can provide an approximate figure for net-worth, the exact figure will be verified on due diligence.

Q. 44 From the list of Directors/Partners displayed on the platform, one or more Director/Partner have left the organization and new Director/Partner has joined. Can I make corrections in the list?

Yes. The borrower is provided with an option to delete as well as add Directors/Partners. To Delete – Click on the "Bin icon" next to "Net Worth" box. To Add – Click on the "+" sign located in line with "Partner Details".

Q. 45 Can I proceed with the details of only one Director/Partner?

No. In case of Partnership Firms and Companies, details of at least 2 Directors/Partners are mandatorily required.

Loan Details

Q. 46 What can I do if my Industry is not displayed in the Industry List?

In case a Borrower’s Industry is not displayed in the provided list, the borrower can complete the journey using "Others" option provided in the Industry List.

Q. 47 I do not have the MSME Registration Number/ Udhyog Aadhar Memorandum Number. Can I proceed with my application?

The fields for MSME Registration Number and Udhyog Aadhar Memorandum Number are not mandatory and borrower(s) not having either number can leave the fields blank and move on to complete the application.

Q. 48 What is Promoter Contribution?

The promoter contribution is the % of loan amount that the lender requires the Promoters to invest/ contribute out of their personal funds.

Q. 49 On clicking "Submit" button, error appears as "Banks require a minimum of 8% to 30% as Promoter’s Contribution". How to Proceed?What is Promoter Contribution?

The above-mentioned message is displayed when the lender products with which your proposal is matching requires a higher percentage of Promoter’s contribution. Enter a higher amount in promoter contribution. In case you cannot enter the amount in Promoter’s Contribution as required/ suggested, please write us at support@capitaworld.com.

Q. 50 What is Incremental Turnover and Incremental Margin?

The Incremental Turnover is the increase in turnover that the borrower anticipates if he acquires the Machinery/Equipment. Similarly, Incremental Margin is the increase in margin that the borrower anticipates if he acquires the Machinery/Equipment.

Q. 51 What is Commercial Operation Date?

Commercial Operation Date is the date on which the borrower anticipates the Machinery/Equipment will be brought into commercial use. Borrower can provide an estimated date.

Q. 52 I do not have any collateral security to offer, will this have any adverse effect on my proposal?

The borrowers can proceed even if there is no collateral security to offer. On https://www.psbloansin59minutes.com, we provide the borrowers to avail collateral free loans by providing CGTMSE Coverage to the eligible borrower. The eligibility of the CGTMSE Coverage is checked in real time.

Q. 53 How are the details of my existing loans being fetched?

The details of existing loans are fetched from Commercial Bureau.

Q. 54 There are loans displayed in the Existing Loans section, but the lender’s name does not appear in the drop down. How can I proceed?

The borrowers who have Existing Loans being displayed but the lender’s name is not being displayed in the drop down, can select "Others" option provided in the drop down. The same will be verified during due diligence.

Product Matching

Q. 55 Can I change the E-Mail Address to verify if I am unable to receive the OTP in the E-Mail Address provided?

The borrower will be provided an option to edit the E-Mail address. The OTP to verify the E-Mail Address will be sent to the new E-Mail Address provided by the borrower.

Q. 56 There are several matching products being displayed, how can I choose one?

The borrower will be displayed all the products that has matched with his proposal, the selection of one from them is at borrower’s discretion. The user can compare the Amount, Rate of Interest and Processing Fees (%) offered by various lenders and select any One Lender.

Q. 57 The Eligible Loan Amount is lesser than the Loan I require? How to proceed further?

The Eligible Loan Amount is being computed considering various parameters set by the lenders. The Borrower can proceed with the reduced loan amount if he/she wishes.

Q. 58 Why do I need to select a branch?

The branch selection is done to smoothen the process flow. If the borrower receives an in-Principle approval, then the proposal is directly sent to the selected branch for processing. In case the borrower is deemed ineligible then the borrower has an option to send his proposal manually to the selected branch.

Q. 59 While selecting the branch, the branch I want to send my proposal to is not being displayed in the list. How to proceed?

If the branch you wish to select is not displayed in the list of branches, then you can either select an alternate branch to send your proposal or contact us on support@capitaworld.com.

Convenience Fees

Q. 60 Is the Payment of Convenience Fees a guarantee that I will receive the loan?

The In-Principle approval is given based on the data provided by the borrower. After receiving the In-Principle Approval, the lender will conduct a thorough due diligence and will take a call on whether to Sanction/Disburse the proposal. The final decision will be at the lender’s discretion.

Q. 61 Is the payment of convenience fees mandatory to receive an in-principle approval?

Yes, the payment of convenience fees is mandatory for receiving an In-Principle Approval.

Q. 62 Will I get a receipt for the amount I pay?

Yes. The borrower will be sent a receipt along with the In-Principle approval letter in the verified E-Mail Address of the borrower.

In-Principle Approval

Q. 63 I have received an In-Principle Approval Letter. What do I have to do now?

Congratulations!!! on receiving the In-Principle Approval. The branch you have sent your proposal to will contact you shortly for due diligence proceedings. In case there is no correspondence from the lender’s side, you can visit the selected branch with a copy of the In-Principle Approval Letter.

Q. 64 Is the In-Principle Approval Letter a guarantee that I will receive the loan?

The In-Principle approval is given based on the data provided by the borrower. After receiving the In-Principle Approval, the lender will conduct a thorough due diligence and will take a call on whether to Sanction/Disburse the proposal. The final decision will be at the lender’s discretion.

Q. 65 I am unable to download the In-Principle Letter. How to proceed?

The borrower is sent a copy of In-Principle Letter on the E-Mail Address which will serve as a valid copy.

Q. 66 I have downloaded the In-Principle Letter. However, the letter is blank. How to proceed?

The borrower is sent a copy of In-Principle Letter on the E-Mail Address which will serve as a valid copy.

Q. 67 The branch selected and the details of branch in the In-Principle letter are different. How to proceed?

Kindly contact the branch you want to submit your proposal with a copy of In-Principle letter.

Q. 68 Will I receive the amount mentioned in the In-Principle Letter, or it can change?

The amount mentioned in the In-Principle Letter is computed based on the data submitted by the borrower. If there is deviation or discrepancies discovered during the due diligence proceedings, the amount is subject to reduction.

In-Eligible Applications

Q. 69 If I have been deemed ineligible, why am I asked to select a branch?

In case the borrower’s proposal is considered ineligible on the platform, the borrower has an option to select a branch to forward his proposal for manual processing.

Q. 70 What is the process for Manual Processing of proposal?

Once the borrower selects the branch where he wants to submit his proposal for manual processing, an E-Mail is sent to the borrower as well as the branch. The branch will contact the borrower within stipulated time to consider the proposal for manual processing.

How do i edit the saved application in case I’ve entered wrong details.

Please restart the process and re-enter the details. You may call the Toll Free helpline Number at 1800 103 7491 or send an email to support@capitaworld.com for assistance.

Wow convenience fees is a hefty 1000 bucks. Go straight to manual processing. It’s a clever move to fill the treasury.

In principle approval means nothing other than govt making a cool 1000 bucks. 10000 pay and they got a crore. Govt business good business

This is a token amount charged to discourage non-serious applicants. All lenders and their processing agents charge a processing fee.

i tried to upload the bank statements in pdf (bank generated with password) . Despite uploading statement of April to March, its giving validation error. I tried the other option (providing login password of Bank of india) but that also failed. Not sure whom to approach for the help. Not able to proceed to the next steps despite 5-6 attempts

Sorry to hear that you are facing difficulty. Can you save the pdf without a password and try again. A password protected pdf cannot be read by the system. You may call the Toll Free helpline Number at 1800 103 7491 or send an email to support@capitaworld.com for assistance.

can i change bank after loan approval?

Yes but it will entail reappraisal by the new Bank and lead to delay. Each Bank will consider the loan application as per their own criteria.

As informed in FAQ, I will receive in-principle approval letter on my registered email after selecting branch and paying convenience fees. After paying convenience fees, i have not received in-principle approval letter on my registered email-id. Though i have taken screenshot of the in-principle approval message received on-screen.

What i have to do now?

There may be some delay owing to the huge volume of applications. Please wait some time. You may call the Toll Free helpline Number at 1800 103 7491 or send an email to support@capitaworld.com for assistance.

After uploading bank statement I m getting error

Calculated transaction balance do not match reported values after complain not getting any feed back but they will call u shortly

Sorry to hear about the problems you are facing. Please ensure that the bank statements are clearly legible. Since a computer system is processing the data (and not data) slight reading problems can trigger an error.

If the problem persists, please call the Toll Free helpline Number at 1800 103 7491 or send an email to support@capitaworld.com for assistance.

Please also see the FAQ:

Q. 37 I have Bank Statements in Physical Form. Can I upload after scanning them? (MSME)I have Bank Statements in Excel. Can I upload them directly or by converting them into PDF files?

The Bank Statements that the borrower needs to upload should compulsorily be in the PDF format and should be downloaded from Net Banking Facility or received from the Bank every month. Any other format converted to PDF format will not be accepted.

Name of bank mention in in-principal loan aproval did not respond.can we go for other bank?

Yes. You are free to go to any other Bank if the chosen Bank does not respond in a timely manner.

The same situation for me also, the bankers didn’t responds since last 2 Months, either need to apply new or shall I proceed with the same application, Kindly revert me.

Can a salaried person avail loan for starting a new business through this portal???

If yes then what documents are required and what will be the procedure…

Yes, salaried persons desiring to start a new business are also eligible. Please register for GST because that is an essential requirement to avail of MSME PSB loans. Your income-tax records must also be available. The rest of the requirements are the same

We have received inprinciple approval and there is no action from the bank side, when we contacted the branch they said, this is only political stunt, no loan will be given like that.

Is this real? can we get or not?, if not kindly refund our money and dont just do only for public attraction.

Where to escalate if the people are not taking such actions on disbursal.

Once, we got inprinciple, means they have verified the details,then only we got this letter.

Any way it is just for elections game as we conider

Sorry to hear about your problem. Ultimately, the discretion to give the loan rests with the Bank based on their in-house credit appraisal mechanism.

The FAQ has made it clear that in-principle approval is merely of eligibility but does not guarantee sanction of the loan.

The PSB loan in 59 minutes scheme is not a political stunt. Several hundreds of candidates have been granted loans already.

This is made explicit in the FAQ in the following words:

“The In-Principle approval is given based on the data provided by the borrower. After receiving the In-Principle Approval, the lender will conduct a thorough due diligence and will take a call on whether to Sanction/Disburse the proposal. The final decision will be at the lender’s discretion.”

Dear MSME Admin,

No action was taken from bank, I visited the branch after 10 days of my in principal approval, but they told we are not yet ready to give any loans based on politicians words and they did not even received my application.

So it is just a political stunt, and in fact they looted money from MSME businesses.

Very cheap public stunt made by Govt.I never expected this from Modi Govt, At least there should be a proper monitoring team.

Regards

Ashok

Then they have thr own appraisal it means this pre approval appraisal is meaning less. 5months have passed after the pre approval, even ready to give a collateral security still things moving at a speed which is very very slow… An sme if has to wait for 5-6months for Loan it will die its own death

We have received inprinciple approval and there is no action from the bank side, when we contacted the branch they said, this is only political stunt, no loan will be given like that.

Is this real? can we get or not?, if not kindly refund our money and dont just do only for public attraction.

Where to escalate if the people are not taking such actions on disbursal.

Once, we got inprinciple, means they have verified the details,then only we got this letter.

Any way it is just for elections game as we conider

Replied above

You are right.

Same thing Is happened with me too..

I apply for the loan on 22nd October. My account is in Central Bank of India and I attached the statement of this account. But when I apply for the loan there are only four banks attached to the portal. There is no name of Central Bank of India. That’s why I have select state bank of india. I receive in principle approval. But now I want to change the bank. Will my application send the Central bank of india?

Central Bank of India is one of the partner banks under the PSB Loans in 59 minutes scheme. So, you may take the in-principle approval to the Central Bank of India for further processing of your loan. Good Luck!

My account is not in any bank in listed 12 bank…my current account is Maharashtra gramin bank …so how can apple or which bank i am choosing

Maharashtra gramin bank is not one of the partner banks under the PSB Loans in 59 minutes scheme. So, please approach any of the other banks listed in the portal for sanction of your loan. Good luck!

I DIDNT SUBMIT A XML FILE OF INCOME TAX IN PSB LOAN. GIVE ME SUGGESTION FOR THIS ERROR

REGISTERED MOBILE: 8507399786

REGISTERED EMAIL ID: AJAYMTR91@GMAIL.COM

XML FILE OF INCOME TAX return is essential to avail of loan under the PSB Loans in 59 minutes scheme.

Please go to https://www.incometaxindiaefiling.gov.in and click on the Link: “How to get XML file of your ITR?” Follow the instructions provided to download the XML files from the and upload the same on the platform.

Calculated transiction balances do not match reported values this is showing me when i upload my bank statement please explain what is this?

This error occurs if the pdf file is not entirely readable by the system.

Please ensure that the bank statements are downloaded from the Net Banking Facility. Any other format converted to PDF format will throw up errors.

Alternatively, you can choose to provide the Credentials for Net Banking i.e. the Login ID and Password.

The PSB Loans in 59 minutes platform will automatically fetch the required data.

Follow below mentioned steps to upload Bank Statement using Net Banking Credentials:

a. Select the number of accounts you want to upload.

b. Tick “Login with Net Banking” and Click on “Net Banking” Button.

c. Borrower will be redirected to Net Banking Page

d. On the Net Banking page, select your bank from dropdown list, provide your Login ID, Password and Confirm Password

e. Click on “Next”

f. If prompted, provide OTP or Access Code and Click on “Submit”

g. The borrower will be redirected to Bank Statement Upload Page, where he can proceed to upload another statement or can move ahead by Clicking “Proceed”

ALREADY GOT THE IN PRINICIPAL APPROVAL BUT THE SBI BRANCH NOT READY TO ACCEPT ALL THE DOCUMENTS THEY ARE ASKING T O COME AFTER 15 DAYS

Sorry to hear about your problem. Please be patient. There is a huge rush of applicants under the PSB Loans in 59 minutes platform.

The Banks have to process all the applications and this may take time.

I had uploaded last six month bank statement but after loading it shows error that is calculated transaction do not match reported values.

Please see the reply given here: https://consumercomplaintscourt.com/articles/msme-loan-in-59-minutes-complete-guide-faqs/#comment-1429

After completion of form and everything i got approval of around 1.8 lack but when i want to pay the convinience fees the link does not proceed .I called in the toll free number but they say sir login from another number but today i tried so many times but i page got hanged again and again .Cant be able to again proceed with the application .Whats the problem please tell

Dear Sir,

There is no option for registering one person company.It is asking for Second Director details at the time of submitting,after filling up the first director details.The details of the problem has to be mailed to your customer support but still the problem has not been resolved.The same problem is prevailing for past 10 days and it could not be resolved by your customer support team.

ERROR AFTER UPLOADING BANK STATEMENT SAYS “THE FILE NOT SUPPORTED, PLEASE UPLOAD BANK GENERATED PDF”.

I HAVE ATTACHED THE PDF SENT TO ME BY BANK BRANCH.

If the pdf is creating a problem, please provide the credentials for Net Banking i.e. the Login ID and Password. The platform will automatically fetch the required data. Follow below mentioned steps to upload Bank Statement using Net Banking Credentials:

a. Select the number of accounts you want to upload.

b. Tick “Login with Net Banking” and Click on “Net Banking” Button.

c. Borrower will be redirected to Net Banking Page

d. On the Net Banking page, select your bank from dropdown list, provide your Login ID, Password and Confirm Password

e. Click on “Next”

f. If prompted, provide OTP or Access Code and Click on “Submit”

g. The borrower will be redirected to Bank Statement Upload Page, where he can proceed to upload another statement or can move ahead by Clicking “Proceed”

MSME Outreach Programme provides In-principle Loan in 59 minutes but does not provide any support in getting this loan disbursement. Had applied for MSME loan for 3 clients of mine and got In-principle sanction in all three after paying an amount of Rs. 1180/- in each cases. Post getting approval bank never approached clients. On contacting branch manager, straightaway rejection was given to clients since they have an exposure from other bank ( whatever an amount be). Modiji can’t bring Ache Din in India alone untill our system and infrastructure support his decision. Bank Manager treat MSME borrowers without like beggars and does not entertain at all. Also they named such scheme as fraud by government.

Its true Deepak Agarwal ji. I also applied through this portal and got a in-principal approval letter immediately. I had applied on 19-Oct-2018 once I came to know about this portal, since that time I have not received any call from bank or portal person. Once we call to customer care center they will just say drop a mail with your concern and once we drop a mail no reply from them even though we are sending reminders. Now when I call to there customer care center again they are saying email id for support has changed now and send mail again. How could within a 1 month email id has changes and if changes does it means all older mails should discard. And there customer care center representative are really pathetic persons. I think this portal is launched just to make one more scam and not to help small entrepreneurs, businesses.

Deepak ji can you please drop your contact number Lakshman.roy@gmail.com

I would like to have your guidance.

Its true Deepak Agarwal ji. I also applied through this portal and got a in-principal approval letter immediately. I had applied on 19-Oct-2018 once I saw that news on websites, since that time I have not received any call from bank or portal person. Once we call to customer care center they will just say drop a mail with your concern and once we drop mail no reply from them even though we are sending reminders. Now when I call to there customer care center again they are saying email id for support has changed now and send mail again. How could within a 1 month email id has changed and if changed does it means all older mails should discard. And there customer care center representative are really pathetic persons. I think this portal is launched just to make one more scam and not to help small entrepreneurs, businessmen’s.

hi i wanted to upload the bank statement provided by the bank to me nd converted to pdf by me will it upload in the website

No it will show errors. Please use only the pdf provided by the Bank and not a scanned pdf.

You did not enter the value in the correct format [ ERROR MESSAGE

While entering 1.5 crores in this 1,50,00,000 I’m receiving the above error

Can you try entering the figures without the commas.

We are a MSME with Proprietory Concern, we were trying to upload a request for Loan sanction, however ITR xml is required for proceeding further. We have uploaded our ITRs in an online submission mode, hence there is no xml available for download from ITR portal.

Please guide us how to proceed further.

You can opt to provide Login Credentials of https://www.incometaxindiaefiling.gov.in

Follow below mentioned steps:

a. Provide ‘Date of Incorporation’ below the ‘PAN’

b. Click on “Login” and you will be redirected to another Page

c. On the redirected page, provide the ‘e-filling password’ and click on “Next”

d. Enter the CAPTCHA displayed on the screen and click on “Submit”

e. Borrower will be redirected to Bank Statements Page

im alreday a pmegp loan holder . my 59 minuts loan approved too . am i alegible for this..

The fact that you have a loan under the PMEGP scheme is not a bar in your availing a loan under the MSME loan scheme if you satisfy the eligibility conditions.

Before paying I would like to ensure the Data entered in Various headings.

If not possible, shall I delete the entered data and can i register again with

the same mail id & phone?

The payment has to be made at the last step. So, if there is a glitch, you will be able to correct it before payment.

Is the loan provided will be CC limit or Term loan

You can opt for either a cash credit or a term loan depending on your requirements and the interest rate charged.

Our income tax return of 2018-19 had be verified but their is problem when we filled that ITR in xml problem .. what we should do ??

Their is any other options to slove this we want to fill this loan application but for this problem we not move ahead from this step

If there is a problem with the xml file, you can opt to provide Login Credentials of https://www.incometaxindiaefiling.gov.in

Follow below mentioned steps:

a. Provide ‘Date of Incorporation’ below the ‘PAN’

b. Click on “Login” and you will be redirected to another Page

c. On the redirected page, provide the ‘e-filling password’ and click on “Next”

d. Enter the CAPTCHA displayed on the screen and click on “Submit”

e. Borrower will be redirected to Bank Statements Page

my application was accidentally deleted . what show i do next ? for in principle sanction.

what utter bull. i tried applying for a loan and came to know of certain facts. capitalworld is an entity owned by bjp members and all your convenience fees goes to them. sidbi only gives in principle approval, so capital world collects all the convenience fees without any liabilities. why another joomla?

Dear Sir,

we VTP Water Technologies was applied the loan for business from your website but still we have not get any other reply from bank side….what we can do now….

i can get loan approval letter in 19.11.2018.but nobody calling to me for the further procedures till this time?

Andhra bank is not replying on loan approval, we have submitted all the documents, its 15 days almost and no reply. They showed as they dont know about this scheme and are not aware of any such scheme by Government

1.Start up MSMEs with turnover less than Rs.20 Lakhs per annum are excempted from registration with GST.Can they apply for loan?

2.Bank statements do not have details of all transactions for start ups.Is this ok?

we receive in principle loan approval of one crore , when we contacted said branch they advised us it is not in our power hence we have rejected .

The Branch Manger advised that he has discussed with their senior authority & advised us to apply again in Main Branch from their they will process the loan .

Our Bank didn’t give statements in PDF format, only one option print and save in PDF format. it will show errors, What i DO, please help me

i have scan and attached bank statement in pdf format but its not getting attached

Calculated transaction balances do not match reported values for what reasons

I am facing a problrm while uploading the XML file of my income tax return. I even followed the above given steps as login Credentials of https://www.incometaxindiaefiling.gov.in. Biut despite of so many attempts i am facing the same problem.

My registered mobile nukmber is 9872382222

My registered email id is SUSHILSHARMA21 @LIVE.COM

KINDLY REVERT BACK ME ON THE BELOW GIVEN EMAIL ID

CA2839A@GMAIL.COM

I had received the in principle loan sanction for one crore and I approached the bank with all the valid documents.after some ten days ,I had received a message that my loan application is in HOLD status..

What does it mean?

And what I have to do now?

Can I wait for the bank to give me loan?

Or can I send all those valid documents and the in principle sanction letter to any other Banks?

Can I approach all the other Banks mentioned in your list with that one single in principle letter received for a particular bank..

Kindly reply..

I am a first generation successful business man with no collateral in my hand.

If I really get loan, I will be grateful to the government always.

Thank you,

Truly Yours,

Thirumeni

We have received in principle approval and there is no action from the bank side, when we contacted the branch they denied to process further i.e. no loan will be given. I have already Cash Credit limit with the same bank. The reason given by the bank is that the unit already having a Cash Credit i.e. CC limit are not eligible to avail this facility.

Is this real? can we get or not?, if not kindly refund our money and dont just do only for public attraction.

Once, we got in principle loan approval, means they have verified the details, then only we got this letter and in the form which i have filled there is column of existing outstanding loan details.

We have received inprinciple approval letter and there is no action from the bank side, when we contacted the branch they said, no loan will be given without collateral. they are charging 0.3 % processing fees which we had already paid i.e. 1000+18%GST.

can we get or not?, if not kindly refund our money i.e. 1000+18% GST

Once, we got inprinciple, means they have verified the details,then only we got this letter.

Guys i think we have to file pil in supreme court against this scheme, so they can’t make fool other people.

can I get 2core loan from msme

Not received any reply till date, no email reply from support side at capita world

if my income is nearby 14 lakh as we are the service provider will I have to take gst number if no, then how can I login without gst number for psb loan in 59 minutes

kindly confirm

whether a trader can apply for this loan as he has no MSME registration because he is trading.

We have received an in principle approval letter in 19.11.2018.bank of Maharashtra is our choosed bank.there is no action from the bank side.what I have to do now? please give me a helpful advice…

pdf statment will be not accepted

N Thirumeni says:

November 26, 2018 at 10:14 pm

I had received the in principle loan sanction for one crore and I approached the bank with all the valid documents.after some ten days ,I had received a message that my loan application is in HOLD status..

What does it mean?

And what I have to do now?

Can I wait for the bank to give me loan?

Or can I send all those valid documents and the in principle sanction letter to any other Banks?

Can I approach all the other Banks mentioned in your list with that one single in principle letter received for a particular bank..

Kindly reply..

I am a first generation successful business man with no collateral in my hand.

If I really get loan, I will be grateful to the government always.

Thank you,

Truly Yours,

Thirumeni.N.

I got in principal approval but bank rejected my application citing reason that the company has incurred a loss of Rs.69 lakh on a turnover of Rs.1.07 crore in its first year of operation.

The capital infused is Rs.90 lakh.

Can they reject because of this?

Calculated transaction balances do not match reported values.

what is this comment after submission Bank statment

There is an interface problem while selecting the banking partner.

The dialog box becomes blank where we need to select the bank branch… how to get this issue resolved

Sir,

Mene kal msme me loan apply kiya lekin koi approval nhi hua he… Muje msme ka uam number mill gaya or register bhi hua he lekin abhitak koi response nhi he, yadi time lagta he to bhi bataeye.. Agar mera loan pass nhi hota he to bhi jankari kare mere e-mail pe

Thank you

if my application is rejected first time so can i apply for loan after sometime?

I HAVE TRIED TO UPLOAD BANK STETMENT BUT MY BANK NOT LISTED ABOVE BANK LIST PLS LISTED BANK

I applied for MSME loan at 14.11.2018 and got In-principle sanction after paying an amount of Rs. 1180/- in Post getting approval bank never approached clients. On contacting branch manager, straightaway rejection was given to clients since they have an exposure from other bank ( whatever an amount be). Modiji can’t bring Ache Din in India alone untill our system and infrastructure support his decision. Bank Manager treat MSME borrowers without like beggars and does not entertain at all. Also they named such scheme as fraud by government.

how can i get the loan for new business there is no any option

I applied for loan at 24-10-2018 and got approval for 11 lakhs, and got sanction letter from collectorate,

But till now, the banker didnot receive any messages about sanctioning, they said we donot have power to do anything, its totally central gornment scheme.

Nearly 4 to 5 times I made a complaint with psbloan complaint number and got several complaint ticket numbers. but no use.

So I suggest to all not to apply to this loan, and donot waste the time. It’s just an advertisement scheme. public cannot benefit from this scheme.

I have applied for the loan but bank manager is asking for collateral

I have registered a complaint through your

Toll free number. But till now no response

I have get approval letter 18.11.2018

But I have so many times visited the bank

But they have no response I think bank

People are not interested in scheme

PM will not do anything if bank people is

Not interested

ERROR IN UPLOADING BANK STATEMENT SAYS “THE FILE NOT SUPPORTED, PLEASE UPLOAD BANK GENERATED PDF”.

I HAVE ATTACHED THE PDF SENT TO ME BY BANK BRANCH.

https://www.psbloansin59minutes.org/get-1-crore-loan-in-59-minutes-faq/

SIR,

My Bank statement have two part, i had been asked to upload for six month, from 1/6/2018 to 30/11/2018. Hear i had a problem, my account was with allahabad bank in july month till october first week and after that i sifted the account in Bank of Baroda from 20th november till date,

How i can upload the statement

Dear Sir

While applying for MSME loan in 59 Minutes i am getting an trouble “Calculated transaction Balances do not match Reported values”

Kindly advice me to resolving this issue.

Thank you

1. Not able to re-apply the loan request to other banking partner. (The first request is rejected)

2. How to delete the application?

If any person already had a loan under mudra scheme rs 10 lac then is he aligble for this loan

I’m from West Bengal and My City is not listed in the goven address field.

What shouldI do?

BJP fanda sab Longo ko banate rho this is ealan are jumla

I had filed my 2017-2018 ITR but i got a error that the IT return is not available for the current period, I am facing a problem while uploading the XML file of my income tax return. Kindly advise further.

If collateral security is not required why the bank is asking a security? And is there any rule to provide security for manual procedure. Kindly let me know regarding this collateral security

I do not have gst no.can i apply for loan upto 25 lakhs. ITR is filed by me since last 3years. Reply please.

Sir,mam my name is lohar singh ,sir mera loan psb se approved ho gaya tha ,indian overseas bank se jo roorkee me hai railway road per me document le kr manager ke pass pahuncha to manager bolta hai ki mai aapki file nahi karunga or jab mane reason pucha to koi javab nahi diya or bol diya ki mai aapka loan nahi karunga ,sir mere sabhi document ligal hai jab mera loan psbloan se approved hogaya hai to kya prasany hai sir mane 1180rs bhi katwa diya please sir mera loan karwane ki kirpa kr. Thanks lohar singh mobile number 9675841415. Gmail.-shubhamgujjar5258@gmail.com. Give me any response regarding for my complain shortly.

How can I change bank option ofter register

i constantly get ” we could not process the statement file uploaded by the client ” while uploading bank statement on your website . please advice

Dear sir madem .. I applied for psb59 and get approval 14 12.2018.. file CW-Awc-36956.. bank of india. Sector 17 branch .. I m continuously going to office but AGM over there not listening I handed over the papers also to him but he is making fool of me .. and not doing anything thing .. your call centre line also not responded ..

Kindly tell me what to doo..

How to upload bank statement..

Dear Sir/mam,

I want to cancel my application so what i do? what is procedure for same? how much time they take?

Please guide for same.

Thanks and Regards

Mohit Darji

8108460673

parmarmohit6495@gmail.com

For psbloansin59minutes, not able to upload XML file from income tax India website. Process to download XML file is not indicated on web site. Please improve website & make it user friendly. I had tried many times to download load XML file from income tax India website but won’t be able to download the same.

Is GST mandetary for PSB59?

As my products doesnot comes under GST.

SO WHAT SHOULD I DO to available PSB59 loan?

As my company is a new entity, registered 4months back, IT returns have not been filed.

how to proceed further with the online application ?

i made a mistake in filling the form which could have a bearing on loan approval, kindly suggest me what should i do

How to reset password

I have received one sms from psbportal on 25th jan this year that my proposal has been sanctioned by BOB and as per psb support it is an offline sanction offered by the bank. Now till today the said branch of the bank is not showing any interest till today.

Dear Team

I am facing an issue while uploading ITR in the portal. Files have been saved in XML format but while uploading it shows a error as mentioned below.

“It seems you have uploaded incorrect XML(s). Please upload correct XML format for the company which you entered GST details”

Please advise on the same

Dear sir

While submit bank statment it shows

Calculated transactions balances do not match reported value

What does this mean? How can I resolve this?

Kindly reply

Amit Sharma

9664150736.

Hello,

I have been trying to apply for a loan since yesterday uploaded all documents but getting error message after filling personal details as follows

“1 – CR. Your request has been rejected by the Credit Bureau server. Error Message : Invalid Membercode or password . Please contact your system administrator. ”

Please look into the matter. Thanking you.

Regards

Samit Mondal

9231846974

THe application form filled doesnt let us change/update the once it reached payment page.

Please help us start a fresh application !

Existing loan details wrong show in 59 minitues pbs loan application.

At the stage of entering gst details it asks to access api in our gst.. Then i gave the manage access api and confirm.. But in our sidbi page it shows ur gst access denied…. What can i do?? When it accessed??

Whether trading activities are covered under psbloansin 59 minutes

Calculated transaction balance does not match actual. Requires correction.

IF I HAVE ALREADY CASH CREDIT LIMIT RS. 1 CRORES THEN CAN I ALSO ELIGIBLE FOR ADDITIONAL CASH CREDIT LIMIT IN IN MSME 59 MINT LOAN

IF WE HAVE COMMITTED SOME MISTAKE.HOW IT CAN BE RECTIFY WITHOUT REJECTING THE PROPOSAL

when submitting gst it showsThe application has encountered an error, please try again after sometime ! 400 what can i do

Today I have received a MSME loan approval latter from Ministry of MSME, Govt of India, one person name as Mr Madan Kumar told me on the approval latter that your loan has been approved under PMEGP scheme and you need to pay charges 4000 rupees to complete your process.

Account holder name Mr Madam Kumar

Fino bank account number 20017010772

Ifsc code FIN00001001

Please suggest me is that type of approval latter is genuine or false.

It is 100% Fraud. MSME and PMEGP never ask for money to sanction the loan. It is a clear cheating case.

Thanks for your cooperation

IT SHOWS API ACCESS DENIED, WHEREAS I HAVE GIVEN ACCESS THROUGH MY GST WEBSITE.

We had availed the services entailed as per the PSBonline for the working capital loan. The loan was efficiently approved in couple of hours with various options to engage with various bank. We had selected the SBI bank but the number given in the approval letter is found to be incorrect. We have approached main branch of SBI bank in Noida but seems they don’t care about the approval. For last 15 days they have not bothered to even respond or take this any further thus I doubt if their is any sync between the announcements and actual implementation.

Calculated transaction balance does not match actual. Transaction is rejected.

Hi I have a in principal Approval from PSB59 portal but when I aproch the bank they r not give the any so wt I do

i was facing a problem to loan detail in purposed of loan is not opening

I have been trying to apply MSME loan to bank of maharashtra.I am able to fill GST details,bank statements,ITR in profile option.When we apply for loan it is asking to fill personal and other details.After filling it and by clicking proceed it says key personal details successfully updated and system is unable to fetch your bureau report,please raise an issue.I have also made a complaint to support@psbloans59minutes.com.As per their suggestion and replies we tried but unable to find solution.I have been trying it for 3days.In bank all other works are done.we are waiting for this issue to be solved.Give us the solution as soon as possible

i have enabled the api access then also i could not go forward in my application status and is recieving msg api access not enabled everytime.

Hello

Sir/mam

I have done all the things but am not able to select central bank of india. It showing me only pnb and sbi and canera bank. I have My old account in central bank I dnt have accounts in other bank. So, how i can select central bank of india. Please help me.

Mobile number- +919996869993 ,+919671870052