| Name of Complainant | |

| Date of Complaint | September 12, 2023 |

| Name(s) of companies complained against | HDFC Bank |

| Category of complaint | Banking |

| Permanent link of complaint | Right click to copy link |

| Share your complaint on social media for wider reach | |

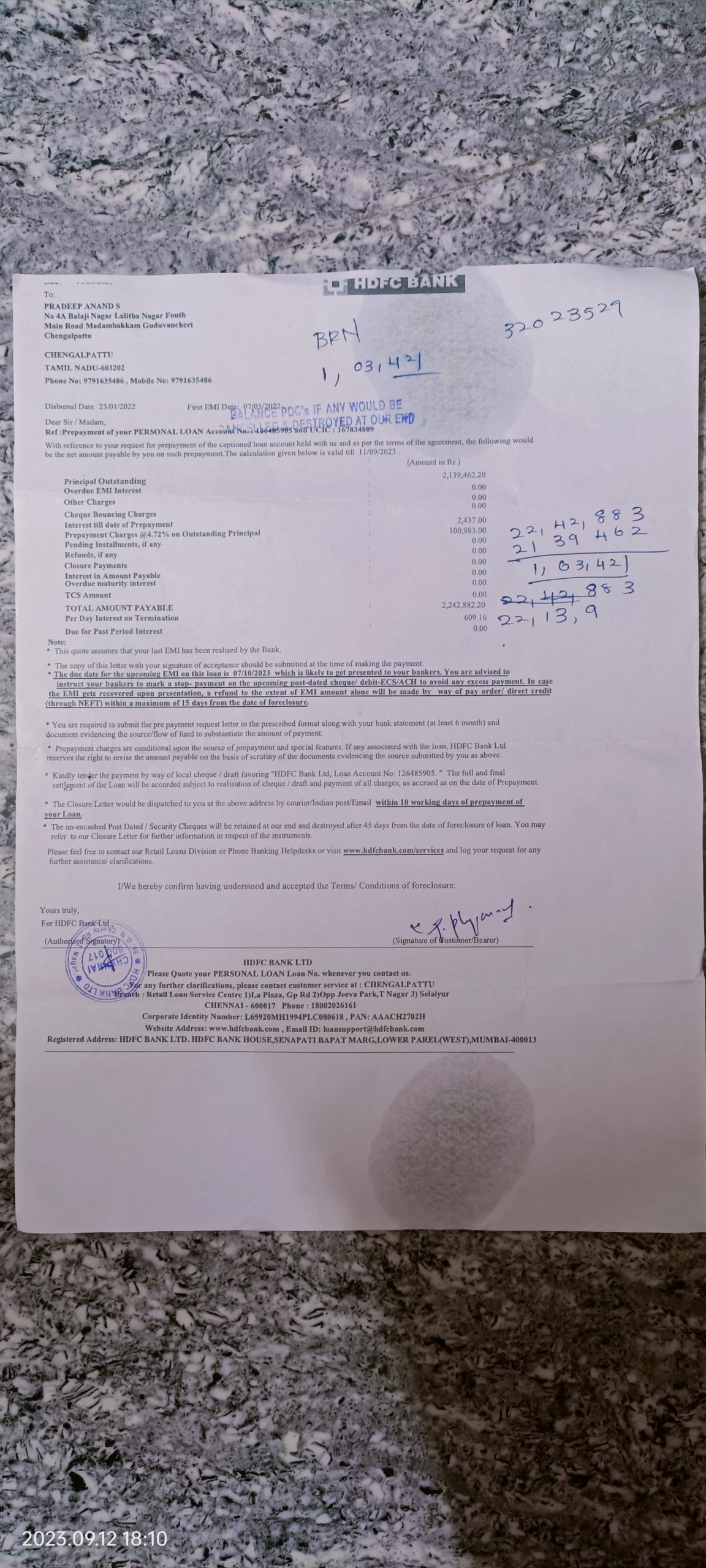

I am Pradeep anand S , I took a personal loan of Rs 270000-/- under the 10.25 rate of interest in HDFC first bank through a telephone conservation with HDFC first bank executive. The loan account number is 126485905. At the time of taking the loan the HDFC executive told there will be no foreclosure charges, if you want to preclosure the loan after 1 year. And after paying the 18 EMI’s , I requested the bank to foreclose the loan. But now they added 4.72% of foreclosure charges to the balance loan amount by stating that it is their bank’s rule. But the RBI circular stated not to take foreclosure charges or prepayment penalty charges on the floating interest rate loans from the individuals. But how come the IDFC first bank charges the foreclosure charges on me by violating the RBI’s circular.

As I am the individual and taken the personal loan on individual basis and not on any other business purposes, so how come the bank charges me with 4.72% of foreclosure charges even I checked in the HDFC back portal and it mentioned 4%. Even I have paid additionally 21,39462 (out standing principal) + 1,03,421 (for 4.72%) because of my situation I have transferred the loan amount to CSB back, so if I delay HDFC will notice for next EMI.

I need justice.

Thankyou.

Pradeep Anand S

9791635486