| Name of Complainant | |

| Date of Complaint | December 18, 2024 |

| Name(s) of companies complained against | Philippine Vastness Lending Corporation |

| Category of complaint | Cyber Crime |

| Permanent link of complaint | Right click to copy link |

| Share your complaint on social media for wider reach | |

Jiroh Marcelino

Attachments

11:57 (4 hours ago)

to cgfd_md, cs, admnjhn43@gmail.com, cybersquad.acg.pnp@gmail.com, customercare, cichelpdesk, cabuyao_mps, secretariat, info, iprd, cybercrime

Dear Sir/Madam,

I am writing to report fraudulent practices by the lending app Vplus, registered under Philippine Vastness Lending Corporation with SEC registration number “CS2019189401”. I have encountered the following issues with the app:

1. False Advertising and Misleading Practices: The app advertises a loan term of 90-180 days, but the actual loan term in the app is only 7 days. This discrepancy misleads clients into believing they have more time to repay the loan.

2. Unfair Interest Rates and Overdue Charges: The app claims there is no interest for overdue payments; however, in reality, the system imposes a charge of 100 pesos for every 6000 pesos borrowed, which equates to 5% interest per day after the overdue period.

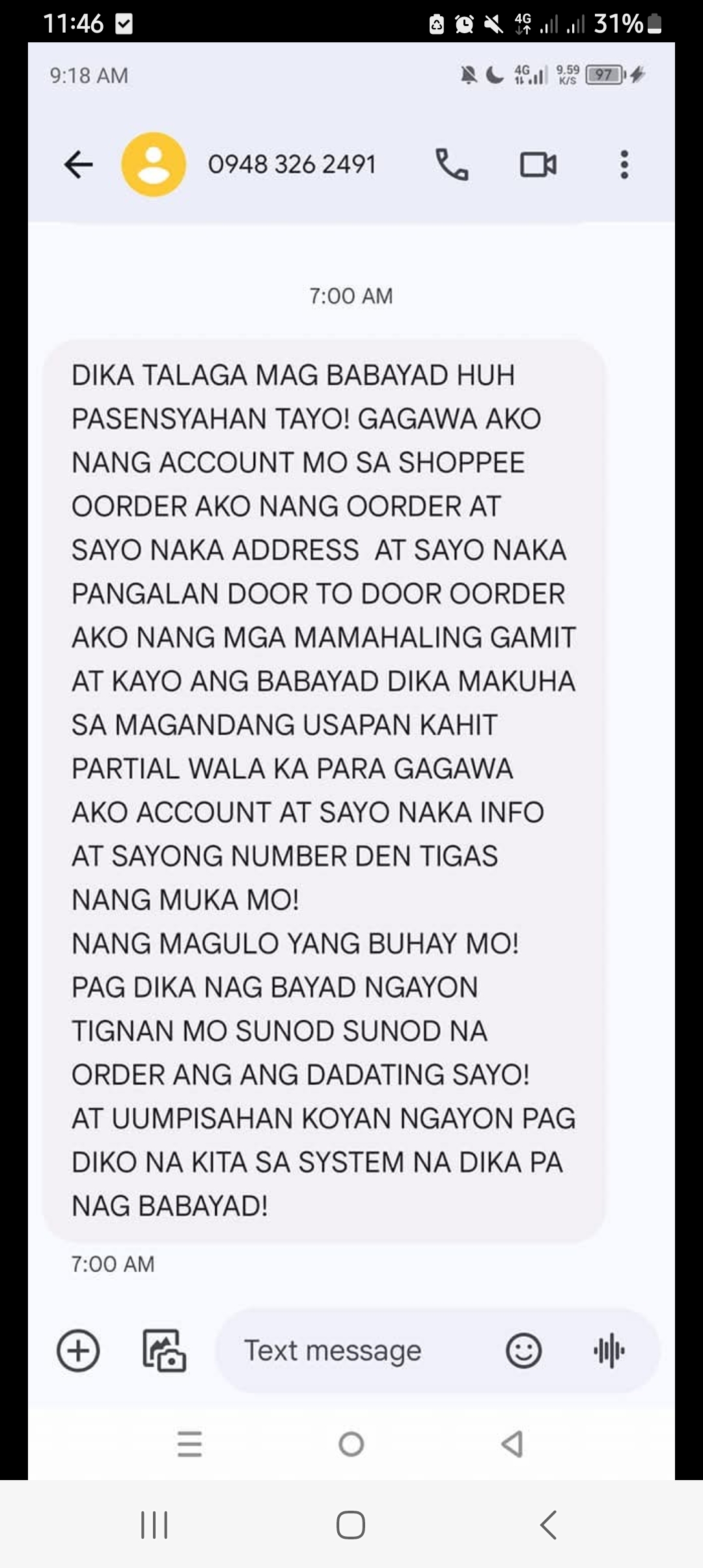

3. Harassment and Unfair Collection Practices: Numerous agents contact clients, often using multiple phone numbers to harass them. Clients are threatened, and their contacts are harassed as well. When clients attempt to discuss overdue payments, they are blocked and faced with further harassment from different numbers.

4. Unlawful Practices and Service Fees: Clients are required to pay a service fee and interest, despite being offered only a partial loan amount. For instance, a client borrowing 6000 pesos is given only 3700 pesos after paying the associated fees, indicating deceptive practices.

Company Name: Philippine Vastness Lending Corporation

Registration Number: CS201918401

CA Number: 3007

Company Address: 26/F W Fifth Avenue 5th Flr Ave Cor 32nd st, Fort Bonifacio Bonifacio Global City 1630 Taguig City,NCR

These actions appear to be in violation of fair lending practices and consumer protection laws, including those outlined in the “Consumer Act of the Philippines” (Republic Act No. 7394) and “Anti-Cybercrime Law” (Republic Act No. 10175).

Additionally, I have discovered that Pinoy Peso seems to share personal information with other lending apps. When trying to apply for loans through FASTCASH VIP – ONLINE SAFE LOAN (Fcash Global Lending Inc.) and MoreGold – Online Cash APP (Thrift Platinum Lending Corp), I was informed that I needed to settle a loan with Pinoy Peso. This suggests that personal data may be shared between these apps.

I urge the SEC to investigate these practices thoroughly as they seem to constitute fraud, unfair debt collection practices, and potential data privacy violations.

The main reason I may not be able to pay is due to recent hospitalisation that renders me unable to work for days. On the screenshot indicated that for a loan of 10k the service fee is 2000 pesos and a repayment of every six (6) days with a repayment or 14k in total for only 24 days versus on the advertised 180 days. I’m also seeking assistance from SEC and local authorities for mediation and protection from the said entity as they are known for harassment in form of calls and SMS.

I am also addressing Vplus about the matter for the incurring penalties that sky rocketted per day, if this continues the amount owed might be impossible to pay anymore due to my current situation that I just got out of the hospital. If you do wish so, I’m willing to meet your representative at our baranggay together with local authorities who can mediate. Thanks.

Image Uploaded by Gerommel rivas Marcelino:

What happen on this case